10 Budgeting Tips Every College Student Should Know (Guest blog)

by Samantha Rupp

If you’re like most college students, you have enough on your plate to think about on the daily, so it’s probably likely that your budgeting and finances are at the bottom of the barrel. But to that point, if you’re like most college students, you’ll also likely graduate with your fair share of student loan debt. What is your plan to stay financially afloat?

If you don’t have a plan yet, don’t stress; there’s no time like the present to create one and teach yourself financial discipline. Managing your money and sticking to a budget may seem like another stressor in your life, but in the long run, you’ll be glad you did yourself this favor early on. Using these 10 budgeting tips, you’ll be better prepared to tackle your next step of life without the weight of your financial reality weighing you down.

1. Create a savings account

What better way to grow your savings account than to start one. Having a separate bank account specifically dedicated to savings will give you a place to deposit disposable income. To sweeten the deal, consider opting for a savings account that offers an attractive annual percentage yield so you can accrue interest as you build up your account.

2. Use a budgeting app

If you’re like most modern smartphone users, your mobile device serves as your trusty keeper of information. No matter what you’re looking for, there’s an app out there that’s specifically designed to meet your exact needs. That being said, there are a myriad of budgeting apps that give you a detailed look into your finances whenever you need to. These apps can even offer spending and budgeting recommendations to make sure you’re always living within your means and making smart financial decisions.

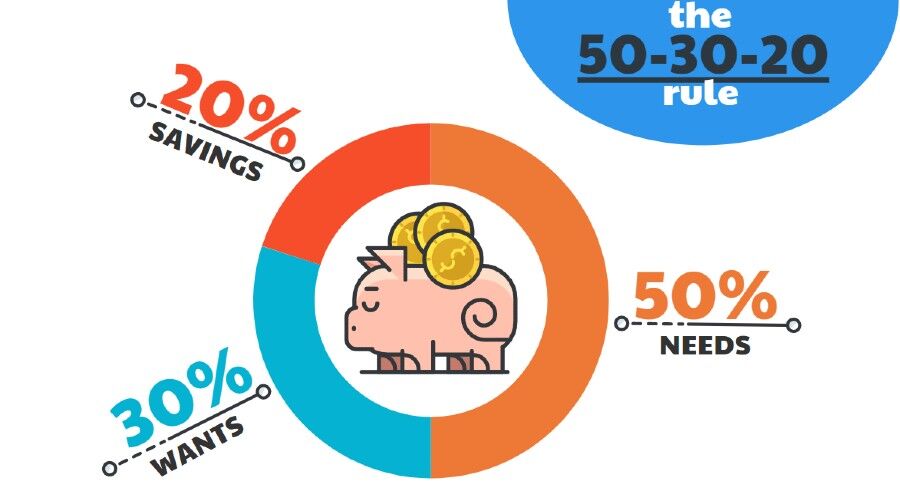

3. Practice the 50-30-20 rule

The 50/30/20 rule asserts that 50% of your income should go toward needs (i.e. rent, gas, moving, etc.), 30% should go toward wants (i.e. groceries, hobbies, extracurricular activities, etc.), and 20% should go toward savings. Feel free to skew these percentages based on your financial goals.

4. Get a head start on your student loan debt

Though you likely won’t be required to start making payments on your student loans until 6-months grace period is over, it’s a smart idea to begin hacking away while you’re still in school. This way you can avoid the grave cost of accrued interest as it builds month over month and year after year.

5. Take advantage of student discounts

Taking advantage of student discounts is a great way to think outside of the box in terms of saving money. Did you know that hundreds of companies offer students discounts? From clothing stores like clothing stores such as Topshop and Steve Madden to tech spots like Apple and Dell, you’ll be surprised to find just how many of your favorite places to shop offer discounts with a valid student ID.

6. Avoid credit card debt

Having and using a credit card is a great way to build your credit score if you make payments on time and use it wisely—however, things can take a quick turn for the worse if you overuse and neglect to pay your due balances. Avoiding credit card debt is far simpler than you may imagine so long as you practice good habits and choose a card that’s suitable for your lifestyle and needs.

7. Buy used textbooks

For the vast majority of college classes, you’ll need a textbook to understand the curriculum, to do your assignments, and to participate in class. A single new textbook can cost hundreds of dollars, and when you need the book for class, you may feel like you have no other option but to dish out the dough.

However, the odds are pretty likely that the same book you’re looking for exists on an online marketplace for used books for a fraction of the cost. Check out Amazon, AbeBooks or Chegg before throwing away hundreds on a book you’ll only need for a semester.

Pro-tip: Pay close attention to the edition and publication date of the textbook you buy, as an older version may not have updated information or the same content as the current version your professor likely requested you purchase.

8. Earn some side cash

Between research papers, lectures, and extracurriculars, your free time is likely limited as a college student. However, if you’re in a financial crunch and want to best position your bank accounts for success post-graduation, getting acquainted with a side gig may be the answer to your money woes.

The key to the perfect side gig is making sure it’s something that’s manageable and enjoyable for you. Be it dog walking, freelance writing, jewelry-making, or uber-driving, it shouldn’t feel like a chore so much as an easy and fun way to make some more money.

9. Start investing

As intimidating as investing may initially seem, it’s actually pretty straightforward to ease into as a beginner. Not only is investing an excellent way to accrue passive income, but it’s also a great way to set yourself up for success years down the road (should you choose your stocks wisely). If you’re brand new to the investing scene, we recommend starting small rather than plunging in and investing every last penny in your bank account.

While investing can be one of the fastest ways to gradually build wealth, it’s important to understand the risk that comes with the territory. There is no predicting how the market will fluctuate, however with the right direction, research, and advice, you can protect yourself and your finances from huge losses.

10. Kick expensive habits to the curb

Maybe it's an expensive all-inclusive gym membership or maybe it’s partying hard at the club with your friends every weekend—whatever your expensive habit is, it may be time to give it up if you want to get serious about creating a budget that works for you.

College is all about getting the best education, finding yourself, having a good time, and setting yourself up for the future. With these ten tips in your back pocket, you’re well on your way to checking all of those boxes!

Author Bio:

Samantha Rupp holds a Bachelor of Science in Business Administration. She is a contributing editor for 365businesstips.com as well as runs a personal blog, sjruppy.com. She lives in San Diego, California and enjoys spending time on the beach, reading up on current industry trends, and traveling.