How to Prepare Financially for a Career Change (Guest blog)

Are you ready to make a significant shift in your career path? If you’re considering jumping ship from your current job to find a new position, you’re not alone. According to the Bureau of Labor Statistics, median employee tenure was 4.3 years for men and 4.0 years for women. However, switching jobs comes with risk — and fears about financial turbulence have stopped many professionals from going after the career they want. Fortunately, there are preventive measures you can take to manage your money before you make that career shift.

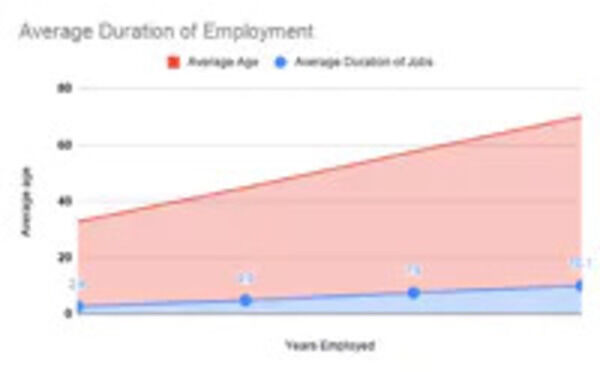

The chart above breaks down the average number of years that people are employed at certain ages. This chart implies the trend that people are more likely to change careers when they are younger. The reason for this can be attributed to the fact that it is easier to change careers when you are younger due to less financial responsibility. It may also be attributed to the fact that people become more satisfied with their career as they become more successful and experienced in their chosen field.

Keep the following strategies in mind:

1. Keep tabs on your spending

Before you make the switch, consider the current state of your finances. How are your monthly expenses faring against your budget? If you’re spending unnecessarily, you can pivot that money flow into a savings account that functions as a financial cushion during your career shift.

It’s important to know where your money is going each month, then set goals around your finances moving forward. If you don’t already keep close tabs on your spending, consider downloading a budgeting app or printing out a monthly financial calendar that you can use to set and track your money moves.

Printable via Intuit Turbo

By keeping yourself accountable through actionable financial to-do lists, you can better avoid frivolous spending during times of transition.

2. Understand the Financial Impact of the Switch

You need to be realistic about what a career change might mean for your wallet. Is the pay range at your planned position higher or lower than your current income? If the pay rate is lower, will you be able to maintain your current lifestyle? In addition, will your new job require further training or credentials? It’s important to factor in the cost of furthering your skillset in pursuit of your new career. Check out sites such as Salary.com to determine the average pay range for the position you’re pursuing, and do the math on how your expenses might change.

3. Build a Rainy-Day Fund

If you don’t already have an emergency savings fund, it’s time to start one. Most financial experts recommend saving up at least three months of expenses; if you find that the job switch wasn’t the right one, you’ll still have money to fall back on.

Image via Shutterstock

4. Supplement Your Income

If you’ll be dealing with a few weeks without a paycheck during your transition, or if your new role will pay less than your current, consider picking up a side hustle to supplement your income. The freelance market is booming, 36% of the population report that they’re involved in the gig economy. If you’re interested in supplementing your income, you can find freelance work through sites such as Upwork.com, GigGrabbers.com, or Fiverr.com.

5. Don’t Touch Your Retirement Savings

Your retirement savings may begin to look very tempting, but don’t drain your account to finance your career change. Pulling your retirement savings out early means dealing with significant tax consequences, and you’ll also negatively impact your long-term retirement goals.

Preparing your finances for a career change can ease the stress of a job overhaul. Keep the above tips in your arsenal and set yourself up for success in your professional and financial life.