The Dollars and Cents of Women and Money (Guest infographic)

Women across the globe face financial inequality in the workplace. Slowly, the situation is improving. Recent statistics about women and money illustrate current economic challenges and provide inspiration for ongoing change to the status quo.

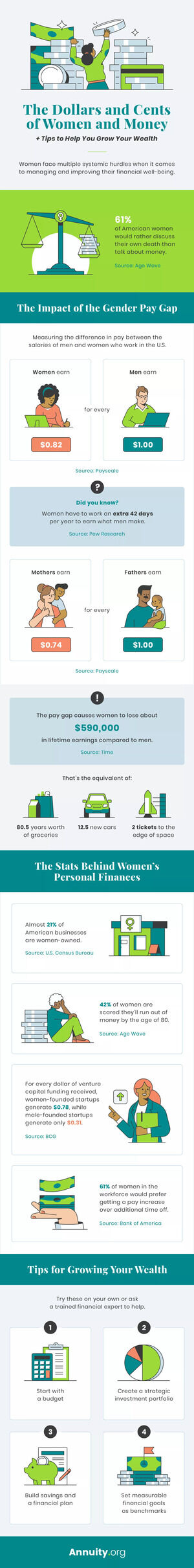

In the United States, women currently earn only $0.82 for every $1.00 earned by a man. This statistic is known as the gender pay gap, illustrating the disparity between salaries of men and women. The numbers become even more stark when you look at women over the age of 45 (earning $0.73 per $1.00) and female parents (making $0.74 per a male parent’s $1.00).

Based on these numbers, the average working woman would have to work an extra 42 days every year to earn the equivalent to their male coworker’s annual salary. The pay difference leads to American women losing out on roughly $590,000 across their lifetime earnings — which is enough money to purchase two tickets to travel tot the edge of space!

It comes as no surprise then that 42% of women fear that they’ll run out of money by the age of 80. With retirement costs averaging approximately $738,000, it’s startling to realize that only 9% of women have saved at least $300,000 for their retirement.

Discussing these challenges while planning for a financially stable future can be nerve wracking and uncomfortable. One survey revealed that 61% of American women would opt for a conversation about their own death instead of talking about money. And another study asserts that 1 in 3 don’t feel prepared to get more engaged in financial investing due to a lack of knowledge on the subject.

The tide is shifting now, with more and more women taking control of their financial future. A survey titled Women, Money and Confidence found that 48% of the female population is quite confident in managing their money. Women actually manage roughly 33% of the United States’ total household financial assets — the equivalent of over $10 trillion.

Female entrepreneurs, and many working women in general, are stepping up as examples of the possibilities women can achieve in business. Currently, 1.2 million American businesses are women-owned, accounting for almost 21% of all American businesses. And female-founded startups are succeeding at an impressive rate. For every $1.00 of venture capital funding they receive, male-founded startups bring in only $0.31. In contrast, female-founded startups generate $0.78 for every dollar funded through venture capital.

With 84% of women acknowledging that a deeper understanding of one’s finances opens the door to greater career opportunities, the need for improved financial literacy is clear. As their confidence in their own financial know-how grows, women can be empowered to engage in the fight for gender equity in the workplace.